Orbiq connects your internal systems, and governance processes with a public-facing Trust Center that proves how you and your ecosystem are continuously secure and compliant e.g. with NIS2, DORA, and other regulatory requirements.

Made in Europe. No credit card required

Ensure every stakeholder can trust you without pulling a security engineer into a meeting.

Stakeholders

Internal systems

Potential savings per year

You've invested in controls and audits. But modern compliance and procurement require ongoing third-party visibility — not a one-time vendor checklist.

Connect the evidence your teams already maintain to an external layer buyers, regulators, and sales can trust.

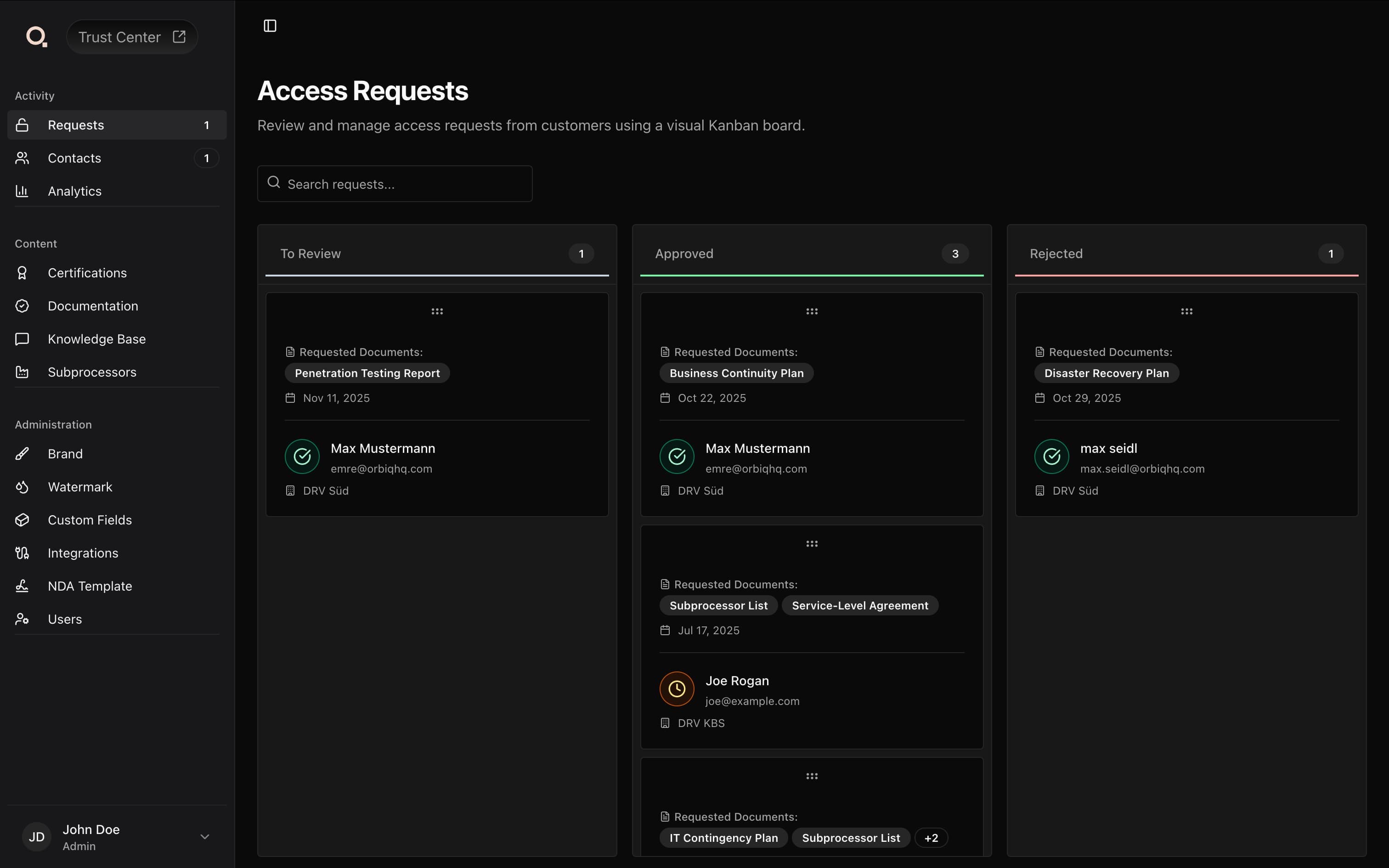

Publish layered profiles—public, restricted, NDA—so every stakeholder sees the right mix of resources, controls, and vendor dependencies.

Map public, customer-only, and NDA-gated experiences to your risk appetite.

Highlight incident response, responsibilities, and supplier oversight in minutes.

Host on trust.yourcompany.com with watermarking, download tracking, and audit trails.

Centralize vendor registers, NDAs, and approvals so NIS2 & DORA expectations are always one click away.

Sync SharePoint, Drive, Confluence, or custom ISMS sources into curated collections.

Publish updates once and notify every stakeholder with full traceability.

Grant access, approve NDAs, and see deal context without leaving your existing tools.

Automate 300-question RFPs with AI. Zero training. Zero retention. Approve before sharing.

Grounded in the same evidence you publish in the Trust Center.

Sales, legal, or security tweak answers before sending.

Respond in your brand voice with references back to your Trust Center.

With Orbiq, our Trust Center handles 80% of buyer questions automatically. Sales cycle shortened by 2 weeks. Customer success loves it too.

Clara Wendt

Head of Security & Compliance

Series B FinTech

We were looking for an EU-hosted Trust Center and are very satisfied with Orbiq. We use the NDA flow multiple times a week with our prospects.

Jonas Fleimer

CISO

SME

Everything from strategic fit to billing is covered in our help docs, but here are the highlights.

Discover how Orbiq can help you streamline compliance, accelerate growth, and build lasting trust.